HOW DOES THE CARES ACT AFFECT YOU?

And how to apply for it if you need assistance

by Stack Sports on March 31, 2020

Last week the U.S. Government passed a $2 trillion stimulus package in the form of the CARES Act. The Act is designed to help several sectors of the U.S. economy and the American people financially as they navigate through the COVID-19 (Coronavirus) pandemic. A portion of the Act is specifically dedicated to small businesses and nonprofits. That is the portion of the Act we want to highlight for you today.

The Act earmarks $370 billion for small businesses and nonprofits, which is good news for any sports organization that has fewer than 500 employees. There are a few ways this Act can help you both short term and long term through grants, loans, and benefits to people who donate to your organization. We’ve provided a summary of the key aspects of the recently announced programs below, but please keep in mind that the government is still providing additional rules and guidance regarding the implementation of the Act.If you have any questions or need help finding the right resources, please reach out to us for additional guidance as you navigate these uncertain times.

Immediate Help

The first part of the Act of interest is the “Economic Injury Disaster Advance Loan,” which is meant to provide immediate help to your organization per the sba.gov website. This help is in the form of a $10K loan advance that will be received within 3 days and does not have to be repaid, even if you don’t secure a larger loan as part of the application. To apply for this loan visit the SBA’s COVID-19 loan application.

The loan can be used for a variety of purposes to help cover your organization’s overhead, including payroll, outstanding bills for your organization including equipment costs and facility or field rentals, fixed debts you may have, or other bills that you are unable to keep up with due to the impacts of COVID-19. See additional information regarding larger EIDL loans further below.

Payroll Assistance

An additional $349 billion is set aside for payroll protection for small businesses and eligible nonprofits described in the Small Business Act (generally those with less than 500 employees who were in operation on February 15, 2020). If you are self-employed or serve as an independent contractor for your organization, you may also be eligible through this program if you meet the program size standards.

Through the Payroll Protection Program, an eligible individual or organization may qualify for a loan of up to $10 million. These loans may be particularly beneficial for organizations with full or part-time staff, and/or paid coaches.

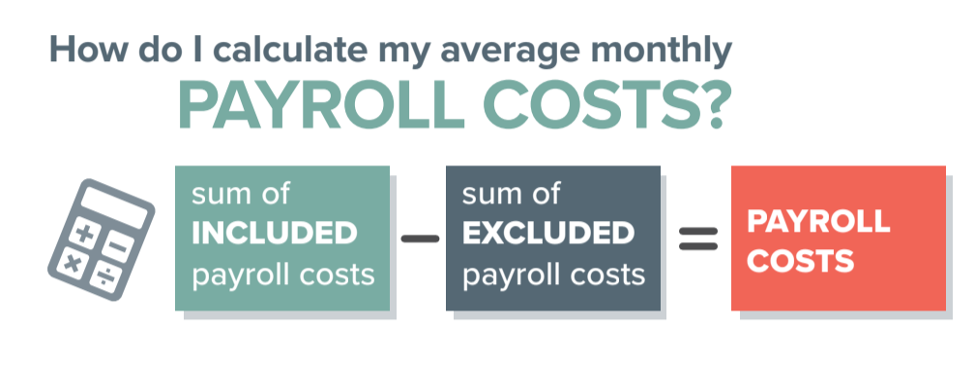

The loan amount is based on the average monthly payroll costs (as defined in the Act) times 2.5. Subject to certain limitations on amounts over $100,000, payroll costs generally include salaries, commissions, tips, payments for leave, separation payments, group healthcare benefits/insurance premiums, retirement benefits, state and local taxes and 1099 independent contractor payments.

Another benefit to the program is that loan payments are deferred for 6 months, and if you use the loan to maintain your workforce and pay for qualifying expenses (payroll, rent, utilities, interest on debt and mortgage obligations), the SBA will forgive a portion or in some cases the entire loan. Make sure you meet the criteria and have a plan to use the loan as intended; it can be free funding to keep your organization running during this period of suspended play. For more information about this program please visit the Payroll Protection Program website.

Payroll Assistance Tax Credit

If a loan is not what you need but are instead looking for a way to offset some cost, you may also consider using the Employee Retention Payroll Tax Credit. If your organization had to suspend operations either fully or partially, you may be eligible for a 50% refundable payroll tax credit for the first $10K in wages or compensation paid to employees.

Both of these are great programs that can benefit your organization. However, please note that you may not take advantage of both of these payroll programs, so it’s important to determine which option is right for your organization before you move forward.

Longer-Term Loans

If you are also in need of a longer-term loan to keep your organization going, the SBA’s Economic Injury Disaster Loan program is another option available for COVID-19 impacted SBA’s through December 31, 2020. It will provide small business financial support to bridge the gap while you are unable to generate all or some of your typical revenues. It is important to note that while these may be helpful, they are still government-backed loans and will need to be paid back at a later point.

These loans are working capital loans and can go as high as $2 million depending on the need of the business. All loans are subject to approval and qualification as with any financing. EIDL’s made in response to COVID-19 of $200,000 or less will not require personal guarantees. The Act authorized an additional $10 billion for such loans.

Benefits for Donors

There are additional incentives for people who are giving to your organization during this period. If you are interested in running a fundraiser, this may be a nice benefit for your donors. The Act allows for a one-time, above-the-line deduction for a contribution of up to $300 made to a qualified charity. This only covers cash donations and does not include in-kind or physical donations. InsideCharity.org also noted that if the person donating happens to file with individual deductions, then the limit on the amount you can deduct would be lifted. That limit is typically 60% for cash for individuals and the normal cap of 10% for corporations is raised to 25% of adjusted gross income. These tax benefits may seem like distant thoughts but as people and companies look to rebound, these benefits may be helpful to highlight to potential donors.

Questions?

The following are answers based on the CARES Act as we have interpreted it. These are subject to change at any time based upon guidance from the SBA and the U.S. government.

Am I ELIGIBLE?

Per the Chamber of Commerce you are eligible if you are:

- A small business or 501(c)(3) with fewer than 500 employees

- A small business that otherwise meets the SBA’s size standard

- An individual who operates as a sole proprietor

- An individual who operates as an independent contractor

- An individual who is self-employed who regularly carries on any trade or business

Important Note: The 500-employee threshold includes all employees: full-time, part-time, and any other status. Additional “affiliation” rules apply which could affect the availability of funds to organizations owned or controlled by venture capital, private-equity or whose owners control multiple businesses.

What will lenders be looking for?

When looking at your eligibility, lenders will generally look for a few things. First, were you in business and operating prior to February 15, 2020? Second, they will look to see if you had paid employees or independent contractors on whom you paid payroll taxes. Third, lenders will look that you certify in good faith that you meet the following criteria:

- That the current economic condition or the uncertainty of the current conditions makes this loan necessary to support ongoing business operations.

- That the borrower will use the loan to maintain employees or make payments to the mortgage, lease or utilities.

- That the borrower does not have a duplicative application or pending application with another lender.

- That the borrower has not received a loan for duplicative purposes or amounts between February 15, 2020, and December 31, 2020.

Are any personal guarantees required?

No.

How much can I borrow for payroll?

The loan can be up to 2.5 times the borrower’s average monthly payroll cost (as defined in the Act) and must be less than the $10 million max.

What documents should I have during the loan process?

See the SBA’s sample application form at the link below. Your lender may require additional documentation in support of the amount of your loan request. You should anticipate needing to gather basic information such as key organizational documents (Articles of Incorporation, By-laws, Operating Agreements), payroll cost support for the last 12 months, tax identification numbers, and employee headcount.

https://www.sba.gov/document/sba-form–paycheck-protection-program-ppp-sample-application-form

Will this loan be forgiven?

The Payroll Protection Program loans are eligible for loan forgiveness as long as you adhere to certain provisions of the Act.

How much of the loan will be forgiven?

The amount that is eligible for forgiveness is equal to how much you spent on payroll cost, mortgage interest, rent and utilities (electricity, gas, water, transportation, telephone, or internet) for 8 weeks from the loan origination date.

‘’Put simply your first 8 weeks’ worth of expenses after you get the loan that falls into these categories above are eligible for forgiveness.

Could I receive less forgiveness or have it reduced?

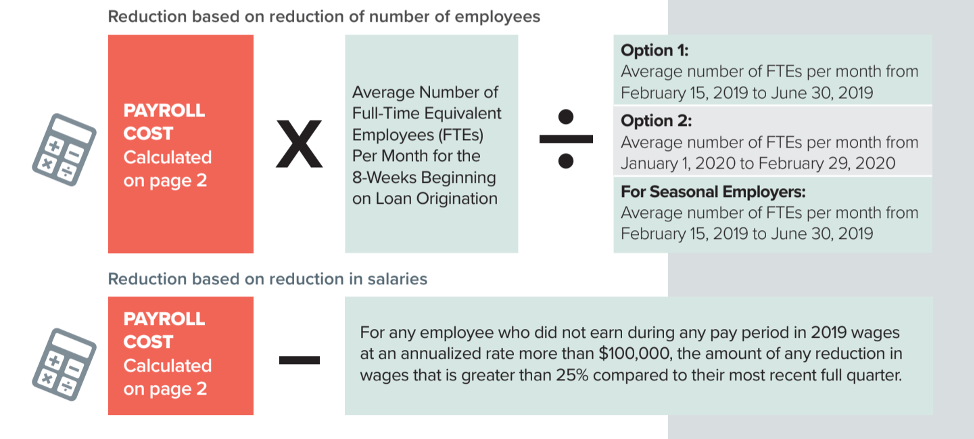

Yes, if you reduce the number of employees or you reduce the amount you pay your employees by more than 25%, you could have your forgiveness amount reduced. Below is guidance from the Chamber of Commerce on calculating a reductions.

Can I use any of this program if I have already had to let people go?

The simple answer is yes, you can apply for this program and, if eligible, receive funding.

There may however be some restrictions on loan forgiveness based on the percentage of employees who were retained and percentage of salaries maintained as of June 30, 2020 in comparison to levels as of February 15, 2020. Potential reductions in the forgiveness amount can be avoided for rehiring employees.

What if I bring back employees or restore wages?

A reduction in employees or wages that occur between February 15, 2020 and 30 days post CARES Act enactment will not reduce the eligible amount of loan forgiveness IF you have rehired the number of employees or employees with wages equal to the previous amount by June 30, 2020. For more detailed guidance please contact the SBA; their number and email are in the resources section below.

What Should I do?

If you are already working with a tax professional or advisor you should consult with them on the options to see what might be most beneficial to your organizations. As your Partner, we would love to answer this question for you, however, each organization’s situation is different and there is no single right answer. Generally, we think this program will be helpful to youth sports organizations that are heavily impacted by COVID-19 and need some financial assistance to make it back into playing seasons.

We strongly recommend consulting with an advisor who has read the Act in detail if you choose to move forward so you understand all of the requirements. In the end, you know your organization the best and we are confident that the decision you make will best fit your organization.

When Can I Apply?

Starting April 3, 2020, small businesses and sole proprietorships can apply. Starting April 10, 2020, independent contractors and self-employed individuals can apply. If a loan is the right answer for business, then we encourage you to apply as quickly as possible because there is a funding cap and loans are expected to be processed in the order of applications received.

Can Stack Sports help me through this process?

We are happy to point you to the resources that can be used to help you navigate this process, however, we are unable to provide you legal or accounting advice. Please see the Resources section below for additional information.

Where can I go to ask additional questions about the CARES Act?

For questions, please contact the SBA disaster assistance customer service center at 1-800-659-2955 (TTY: 1-800-877-8339) or e-mail [email protected].

How can I find more updates about COVID-19 and Youth Sports?

There is a Facebook Group available to you where youth sports organizations are sharing best practices and ideas for their businesses. This is a great place to ask other organizations how they are handling situations or see other questions being asked.

We have also created an Emergency Response Guide which may be helpful in navigating your current individual situation.

Resources

BA.gov

SBA disaster assistance customer service center: 1-800-659-2955 (TTY: 1-800-877-8339) or e-mail [email protected].

Most Active 7(a) Lenders:

https://www.sba.gov/article/2020/mar/02/100-most-active-sba-7a-lenders

Chamber of Commerce Checklist

Sports Connect

Email: [email protected]

Support: :866-258-3303